Categories

About UsHow to get startedAccount AccessOn Chart Trading from the Order Panel

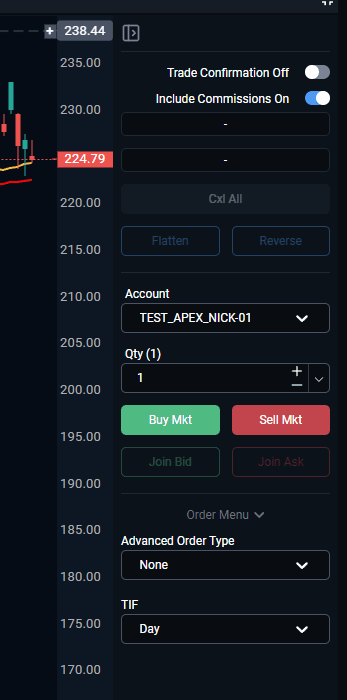

The Order Panel is an essential tool for quickly executing trades directly from your chart. It allows traders to place, modify, and manage trades efficiently without navigating away from the chart they are working on. This guide will walk you through the key components and features of the order panel, enabling you to execute your trading strategies with precision.

Key Features Overview

• Account Selection: Easily toggle between different trading accounts.

• Quantity Control: Set the number of contracts or shares to trade.

• Order Types: Choose between normal and single/multi bracket orders

• TIF (Time in Force): Manage how long an order remains active.

• Quick Trade Execution: Buy or sell instantly at the market price.

• Order Management Tools: Flatten, reverse, and cancel orders directly from the panel.

Detailed Walkthrough

1. Trade Confirmation & Commission Options

At the top of the panel, you’ll see two toggles:

• Trade Confirmation: When toggled on, the platform will require confirmation before executing trades. This is useful for double-checking trades before they are placed. If toggled off, trades will execute immediately upon selection.

• Include Commissions: When enabled, this feature factors in commissions to your trades, allowing you to see the total cost of your trade, including fees.

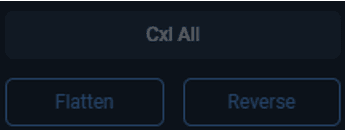

2. Cancel All (Cxl All)

The Cxl All button provides an efficient way to cancel all working orders with a single click. This is especially helpful in fast-moving markets where you need to retract multiple orders quickly.

3. Order Management Buttons

• Flatten: Instantly closes all open positions in the selected account, effectively taking you out of the market. It’s a quick way to manage risk or lock in profits.

• Reverse: This button reverses your current position. If you are long 100 shares, clicking “Reverse” will sell those 100 shares and place a short order for 100 shares, effectively switching your position to the opposite direction.

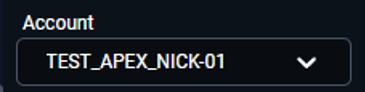

4. Account Selection

Use the Account dropdown menu to select which trading account you want to use for the current trade. If you manage multiple accounts, ensure that the correct account is selected before placing your order.

5. Quantity (Qty) Control

In the Qty section, set the number of contracts, shares, or lots for your trade. You can adjust this manually by entering a number, or use the “+” and “-” buttons to increase or decrease the trade size.

6. Order Execution Buttons

• Buy Mkt: This button allows you to instantly place a market buy order, executing the trade at the current market price.

• Sell Mkt: Similarly, this button instantly places a market sell order, selling at the current market price.

• Join Bid / Join Ask: These buttons allow you to place a limit order at the current bid or ask price, joining the current market participants who are waiting for execution.

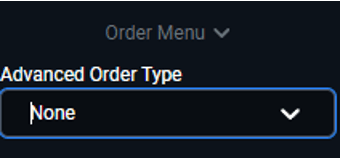

7. Order Menu

Under the Order Menu, you have additional options to customize your order:

• Advanced Order Type: Use this dropdown to select more complex order types. While the default setting is "None" (indicating market or limit orders), you can choose other order types, such as bracket orders, multi-bracket orders, potentially stop-loss orders, or trailing stops depending on your strategy.

8. TIF (Time in Force)

The TIF (Time in Force) dropdown allows you to specify how long the order remains active. Options include:

• Day: The order will be active for the current trading day and expire if not filled by market close.

• GTC (Good 'Til Cancelled): The order remains active until it is either executed or manually cancelled.

Best Practices

• Trade Confirmation: It's recommended to keep Trade Confirmation on if you are trading in fast markets to avoid accidental trades.

• Quantity: Ensure that you always verify the quantity before placing an order, especially when switching between different instruments with varying contract sizes or volatility levels.

• Flatten and Reverse: These are powerful tools but should be used with caution. Flattening exits all positions, while reversing completely changes your market direction, which could be risky in volatile conditions.

Did you know: The chart panel can be hidden – just use the icon below that's located at the top right of each of the charts to hide/unhide it.

Still don't want the right gap where the Order Panel is hidden? Simply right-click your chart and select "Show/Hide Trading Panel"