Categories

About UsHow to get startedAccount AccessBrokers and TradingChartsScannersCommunityStocksOptionsFuturesAlertsMobile AppFundHunter

The FundHunter is a tool that helps you streamline research based on data such as insider activity, buybacks, activity on social networks, high short interest, or important FDA reports. The FundHunter monitors the data sources available to it, and when it detects a spike in activity based on any of the aforementioned factors, it alerts you with an automatically generated report. These can help support and inform your market analysis and supplement chart technicals with a fundamental background.

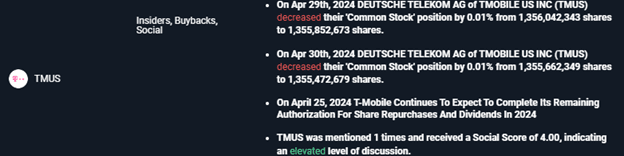

The content of each such report provides the necessary detail on what happened within each case:

In addition to the reports themselves, the FundHunter offers a convenient breakdown of whether corresponding charts are signaling as bullish, neutral or bearish (green, grey, and red dots) on various timeframes – this will help you save precious time by giving a heads up indication as to what is going on for each reported stock on it’s charts.

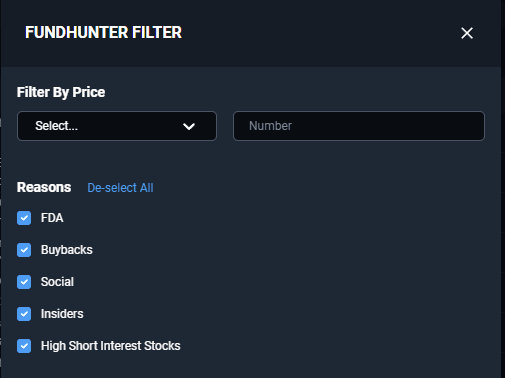

The filters and settings menu allows you to hide various report types, and narrow the list down to only specific symbols. Please note however – some reports can have multiple reasons that trigger them, and disabling even one of the involved reasons will completely hide such reports from the list.

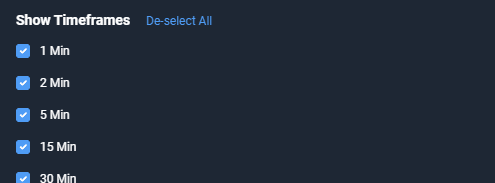

Here, various timeframes can also be hidden from the heads up list of chart signals:

To learn more about FundHunter and watch a video on it, click the video below: